Introduction

If you have never invested before, have money in your pocket that you can set aside for at least three years, we would like to introduce you to a simple way of investing called “Mutual Funds”.

The name mutual fund may seem intimidating to most individuals not familiar with investment products. Mutual Funds have the following advantages:

- Mutual funds are created to make investing low-cost and easy. You can start your investment from as little as Rs. 5,000.

- The investors are not burdened with the responsibility for selecting the stocks and bonds to be purchased with their savings, or the day-to-day management and safekeeping of the investments selected.

Following are some of the most frequently asked questions (FAQs) about mutual funds.

What is a mutual fund?

A mutual fund is a collective investment scheme that pools money from many investors. An asset management company (AMC) duly licensed by the Securities and Exchange Commission of Pakistan (SECP) invests the money on your behalf in securities or other financial assets for profits/gains and income.

There are two types of mutual funds:

- An open-end fund does not have a fixed pool of money. The fund continually creates new units or redeems issued units on demand, and there is no limit on the fund size. The price of the units does not rise or fall in response to demand but is driven by the value of the fund’s underlying assets. Investors can conveniently buy and sell units at net asset value (NAV) through the asset management company (AMC) which announces offer and redemption prices daily.

- Closed-end funds have a fixed number of certificates/shares that are issued through an Initial Public Offering (IPO). Once issued, they are bought and sold at market rates on the Pakistan Stock Exchange (PSX).

In Pakistan, the majority of mutual funds are open-ended funds. Each open-end unit represents an investor’s proportionate ownership of the fund’s undivided portfolio; each unitholder shares equally with other investors in distributions. Investors purchase mutual fund units from the fund itself or from banking/ financial companies authorized to act as distributors/ sales agents. Open-end mutual fund units are not traded on the secondary market such as the PSX.

Under the regulations, an independent trustee registered with the SECP has custody of all mutual fund assets. The trustee is obligated to ensure that AMC Invests the fund’s assets in accordance with the approved investment policy and authorized investments of the mutual fund, and all mutual fund property including cash is registered in the name of, or to the order of the trustee.

WHY INVEST IN MUTUAL FUNDS?

Investment requires fulltime attention to numerous factors that can affect the value of your hard-earned money.

Fund managers at asset management companies are supported by dedicated research teams responsible for monitoring the performance of a fund’s portfolio.

You need not worry about the day-to-day management of your portfolio. Diversification offered by mutual funds simply cannot be achieved by a small investor with limited investment funds.

Mutual funds can provide you with regular income and an opportunity for increasing your savings through reinvestment. Here are the benefits of investing in mutual funds:

- Professional management

Asset management company (AMC) evaluates investment opportunities by researching, selecting and monitoring the performance of the securities purchased by the fund. AMCs employs qualified investment professionals who make calculated investment decisions on your behalf. This is not an easy task for an individual without specialized knowledge.

- Diversification

By spreading your investment across a number of securities and investment sectors, a mutual fund can help lower your risk if a company or sector fails. Diversification can be neatly summed up as “Don’t put all your eggs in one basket

- Affordability

Mutual funds accommodate investors who do not have a lot of money to invest by setting relatively low Rupee amounts for initial purchases and subsequent monthly purchases. For example, you can add funds at set amounts of say PKR 1000- 5000 per month or other intervals. Mutual funds buy and sell large amounts of securities at a time. Your costs for transactions and management fees are shared with fellow unit holders

- Liquidity

Mutual fund unit holders can readily convert their units into cash on any working day. They will promptly receive the current value of their investment within six working days. Investors do not have to find a buyer, the fund buys back (redeems) the units at the current net asset value (NAV).

- Well regulated

The SECP carries out continuous monitoring of mutual funds through reports that the mutual funds are mandated to file with the SECP on a regular basis. In addition, SECP conducts on-site inspections of the AMCs.

- Transparency

The performance of a mutual fund is carefully reviewed by various publications and rating agencies, making it easy for investors to compare the performance of a fund. As a unit holder, you are provided with regular updates, for example, daily NAVs, as well as information on the fund's holdings and the fund manager's strategy.

- Tax benefits

Investment in mutual fund schemes entitles the investor to avail tax credit that enhances the overall return on their savings

WHAT ARE THE DIFFERENT CATEGORIES OF FUNDS?

In Pakistan, the SECP in consultation with the Mutual Fund Association of Pakistan (MUFAP) has devised criteria for categorization of open-end mutual funds together with investment limits. Generally, the higher the potential return, the higher the risk of loss. The SECP has approved the following categories for mutual funds:

- Equity fund

An equity fund invests in equities more commonly known as stocks/shares that are subject to the risk of volatility associated with the equity market. Although this fund is the riskiest, it can provide maximum long-term growth through capital appreciation. An equity fund, as per the categorization, must invest at least 70% of its net assets in listed equity securities. The remaining net assets of an equity scheme can be invested in cash or near cash instruments.

- Income fund

These funds focus on providing investors with a steady stream of fixed income. They invest in short-term and long-term debt instruments like Term Finance Certificates (TFCs) issued by corporations and government securities such as treasury bills and Pakistan Investment Bonds (PIBs). An income fund is considered less risky than an equity fund. Consequently, the opportunity for capital appreciation is limited. Income funds are required to maintain at least 25% of net assets in cash and/or near cash instruments to meet liquidity requirements.

- Money market fund

These funds invest in short-term fixed income securities, for example, treasury bills, government bonds, certificates of deposits and commercial paper. The aim of a money market fund is to maintain high liquidity by investing in low-risk short-term instruments and is generally a safer investment. Returns generated by a money market fund are likely to fluctuate much less versus other types of mutual funds. Money market funds are ideal for new investors as they are the least complicated to follow and understand.

- Balanced fund

A balanced fund provides growth in investment as well as regular income by investing in equities and fixed income securities. The regulatory framework dictates that balanced funds invest 30% to 70% of their net assets in listed equity securities. The remaining balance may be invested in other authorized investments.

- Fund of Funds

Fund of Funds invests in other mutual funds. Every fund of funds must categorize itself by investment objective, for example, equity fund of funds, income fund of funds etc. These funds operate a diverse portfolio of equity, balanced, fixed income and money market funds.

- Shariah compliant (Islamic) funds

Islamic funds invest in Shariah compliant securities i.e. shares, Sukuk (Islamic bonds), and GOP Ijara Sukuk etc. as may be approved by the Shariah Advisor of such funds. These funds can be offered under the same categories as those for conventional funds.

- Asset Allocation Fund

This category of the fund can invest its net assets in several types of securities and investment styles as specified in its offering document. Asset allocation funds are generally considered high-risk funds due to their potential to invest up to 90% of net assets in equities at any point in time.

- Capital protected fund

Under a capital-protected fund, the original amount of the investment is protected. This fund places a major portion of the investment amount in a bank in the form of a term deposit while investing the remaining net assets in accordance with the authorized investments stated in the offering document. Capital protected funds, unlike other funds, have a mutually agreed upon fixed maturity period.

- Index Tracker fund

Index funds invest in securities to mirror a market index, such as the PSX KSE 100. An index fund buys and sells securities in a manner that mirrors the composition of the selected index. The fund's performance tracks the underlying index's performance. Investment of at least 85% of net assets is required in the securities that constitute the selected index or its subset. The balances of the net assets are kept in cash or near cash instruments such as bank deposits (excluding Term Deposit Receipts (TDRs) and Treasury Bills not exceeding 90 days maturity.

- Aggressive fixed income scheme

The aim of aggressive income fund is to generate a high return by investing in fixed income securities while also taking exposure in medium to lower quality of assets. These Funds usually invest in a portfolio of diverse securities including government securities, fixed income debt securities, deposits with the bank(s), certificates of investments and commercial paper etc. At least 10% of the net assets are kept in cash or near cash instruments such as bank deposits and treasury bills not exceeding 90 days maturity.

- Commodity fund

Commodity funds enable small investors to take advantage of gains in commodity and commodity futures contracts such as gold through pooled investments. During the year, at least 70% of the net assets must be invested in commodity or commodity futures contracts based on the average quarterly investment calculated on a daily basis.

WHAT TO CONSIDER BEFORE INVESTING IN A MUTUAL FUND?

Mutual funds differ in terms of investment objectives, strategies, risks, and costs. Before selecting an appropriate category of mutual fund for your savings, you must know your investment objectives. Your financial goals are determined by your level of income and expenses, financial independence, age, lifestyle, family commitments among other factors. Here are some questions that you should ask yourself and likely answers that will help you in selecting an appropriate mutual fund.

- What are my investment objectives?

Likely answers: I need regular income; need to buy a home, finance a wedding; educate my children; or a combination of all these needs.

- How much risk can I tolerate?

Likely answers: I cannot afford to take any risk, or am willing to accept the fact that to earn long-term gain there may be short-term losses.

- What are my cash flow requirements?

Likely answers: I need a regular cash flow; or I want to grow my assets for the future and do not need current cash flow; or I need a lump sum amount to meet a specific need in the future.

- What is my time horizon?

Likely answers: I have a short-term time horizon of less than one year, or medium term, one to five years, or long term, five to ten years

By answering these questions, you will have a clear idea about your expectations from your investment. This will help you determine an appropriate mutual fund investment strategy. Here are a few examples of possible investment choices based on your applicable time horizon.

- Long -term horizon: If you are investing for the long term say five to ten years and want your money to grow, you should consider putting at least a portion of your money in equity mutual funds. A longer time horizon allows you to recover from a market downturn.

- Medium term horizon: Leaving your money invested for one to five years may not allow you to recover from market downturns. You should exercise caution and consider investing in balanced and income funds.

- Short-term horizon: If you are investing for a year or less, there is very little time to recover from losses. You should only invest in mutual funds that have no restrictions on withdrawals and focus on very low risk investments such as money market funds.

To help you plan your investment portfolio, basic characteristics of mutual funds in terms of fund category, investment time horizon, volatility/risk, and allowable investments are presented below:

It is always recommended that you consult with an investment advisor to help you choose the right mutual fund.

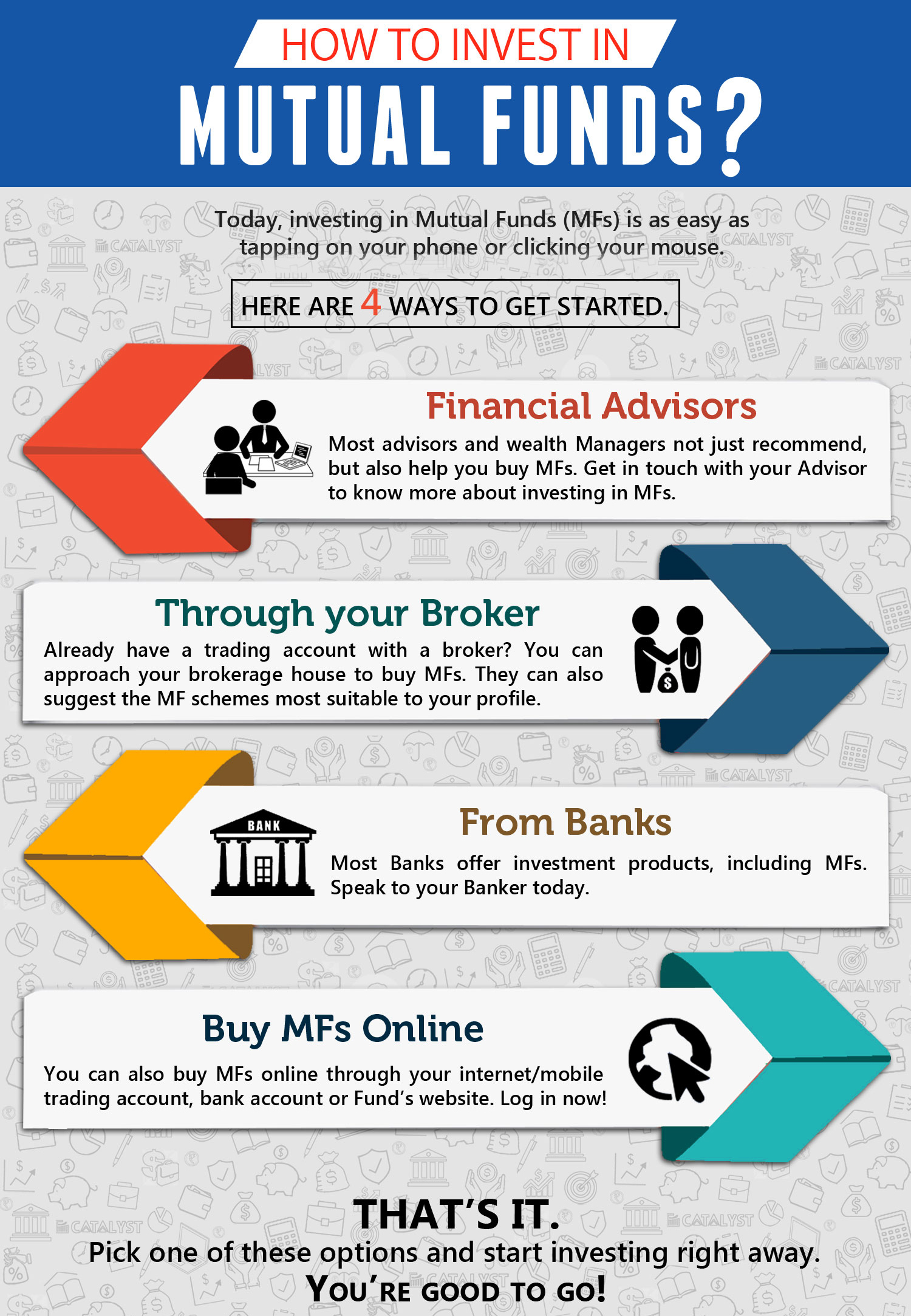

How to invest in your selected category?

First verify license of an asset management company (AMC) using SECP SMS verification services as follows: SMS LV<space>incorporation ID>to 8181.

You can also visit Jamapunji web portal at www.Jamapunji.pk to verify license of AMC. After confirming their license, you should contact the AMC to assist you with your fund selection. It is important that you meet with the AMC representative in person and clearly state your investment objectives, concerns and time horizon.

Here are some questions that you should ask with respect to the particular mutual fund being offered to you:

- How has this fund performed over the long run?

- What is the fund’s ranking on the MUFAP comparison for similar funds?

- What specific risks are associated with this fund?

- What type of securities does the fund hold?

- How often does the portfolio change?

- Does this mutual fund invest in any type of securities that could cause the value to go up or down rapidly in a short period?

- How much will the fund charge me when I buy units?

- What ongoing fees are charged?

- How much will the fund charge me when I sell my units?

You should only invest if you are satisfied with the answers provided. Before handing over your money, you should also study the offering documents, fund manager’s report and review the funds’ performance by visiting the MUFAP website. Returns are provided for various categories of funds for month –to-date, year –to –date and 365 days.

What documents are needed for opening a mutual fund account?

Obtain application form by contacting the AMCs or their designated distributors or by visiting their website. You will need to provide the following at the time of opening an account:

- Copy of CNIC

- Application / Account Opening Form/Purchase of Units Form

- Zakat Affidavit (Optional)

- KYC Form/ FATCA For

- Cheque/pay order/demand draft payable to the respective trustee (make sure to write cheque only in the favor of the respective trustee)

Carefully complete all forms, and read all documents before you sign them.

How do I redeem my units?

Units may be redeemed by lodging a request, on the prescribed redemption form with an authorized branch of a distribution company or asset management company. Some asset management companies’ websites allow you to make online redemption requests. Redemption payments are made to the investors within a maximum period of 6 working days.

In conclusion, please bear in mind that all investments in mutual funds are subject to market risks, and you may lose some or all of your money if the securities held by the fund move down in value. Past performance is not necessarily indicative of future results. The NAV based prices of units and any dividend/returns thereon can fluctuate as market conditions change. Funds with higher rates of return may take risks that are beyond your comfort level and may be inconsistent with your financial goal

Please note that to reduce risk of loss it is always advisable to consult with your investment advisor. While risk cannot be eliminated, the experience and expertise of mutual fund managers in selecting fundamentally sound securities and timing their purchases and sales may result in a diversified portfolio that minimizes risk while maximizing returns.

We hope that by reading the answers to the questions above you have a better understanding of mutual funds and are ready to enter the world of investing.

We strongly recommend that you use the services of an investment fund manager/advisor duly licensed by the SECP to guide you. To know more about AMCs, visit the Mutual Fund Association of Pakistan (MUFAP) at http://www.mufap.com.pk/members.php