Capital Market Related Investments:

- Carefully and completely fill in your Central Depository Company (CDC) Sub-Account opening forms (AOFs) opened through your brokerage. Make sure to obtain a signed copy of the same.

- Enroll for free of cost e-alerts, e-statements and SMS alert services of CDC. Ask your broker to activate them.

- Ensure that you receive an email and/or SMS for every activity in your account and a monthly e-statement.

- Confirm the accuracy of your contact details in Central Depository System through CDC WebAccess or physical report from any CDC office

- For protection of your portfolio consider opening an account with CDC’s Investor Account Service (IAS) and using CDC’s Direct Settlement Service.

- IAS clients can also avail online Portfolio Transfer facility by subscribing CDC online transactions service

- Immediately inform CDC if there is any discrepancy in your account statement.

Insurance Related Investments:

PolicyHolder's Duties and Rights

Policyholder’s duties

As a policyholder you have certain duties as under:

- Provide all required information truthfully;

- Do not misstate or make false declaration;

- Complete the proposal form and nominate the beneficiary;

- Meet all documentary requirements at the time of taking out insurance policy;

- Make claim in accordance with policy provisions and follow the claim process; and

- Complete all documentary requirements for making claim.

Policyholder's rights

As an insurance policyholder you have the right to:

- Choose the insurance product you want from the insurance company of your choice; Do not be influenced by aggressive sales tactics;

- Obtain quotes from multiple insurance companies before making final insurance purchase decision;

- Pay the insurance premium at any time until the grace period expires;

- Shift your investments between various funds in a unit-linked insurance policy;

- Add the riders to your insurance policy at any time, and get additional insurance coverage;

- Ask for any valid benefit stipulated in the insurance policy document;

- Ask the insurance company to act in accordance with the written terms and conditions of the insurance policy;

- Refuse to accept anything contrary to the insurance policy document provisions;

- Lodge complaint with the designated dispute resolution forum regarding maladministration of the insurance company or its representative or agent; and

- Surrender the cash value policy at any time and obtain underlying amount of the insurance policy.

Important documents to keep organized if you are insured

By organizing your financial and legal documents, you will be able to ensure a smooth claim settlement process when the need arises. Below is a list of all documents you must always keep organized so that they can be produced in case of an accidental loss.

| 1. Policy document | 4. Title documents for any property or asset |

| 2. Investment portfolio | 5. Tax returns |

| 3. Bank statements | 6. Any loan documents |

A few, if not all, of these may be required, depending on the type of damage and the type of insurance policy purchased.

Making and insurance claim

How to Make a Claim?

An insurance claim is a notification to an insurance company requesting payment of an amount due under the terms of the policy. This is the right of the policy holder. In case of death of the policy holder the claim can be filed by the nominee as agreed upon at the time of issuance of the policy. There are certain guidelines outlined by the company that have to be met when filing a claim.

- The policyholder should obtain the contact details of the claims department of the insurance company at the time of the buying the insurance policy;

- The policyholder should educate the beneficiary of the policy about the benefits to which he is entitled on the occurrence of death or other insured event;

- In case of non-death claim, the policyholder has to contact the claims department of the insurance company as soon as the loss is incurred. In the event of death of the insured, the nominee of the policy has to make the claim;

- If certain time limit for making claims is specified in the insurance policy terms and conditions, the policyholder is bound to make claim within that specified time limit. Nevertheless, it is in the best interest of the policyholder to file the claim with the insurance company as soon as possible;

- Policyholder ought to make claim in writing if policy terms explicitly require so;

- The insurance company will require certain documents related to claim processing as mentioned in the policy document. It is the responsibility of the policyholder to provide all documents as required and mentioned in the insurance policy document;

- The insurance company will decide on the claim and inform the policyholder or his/her nominee before the claim payment will be made. It is important to note that only the nominee or beneficiary is entitled to receive the insurance claim amount; and

- If dissatisfied with the insurance company’s decision, the policyholder has the right to follow the complaint lodging procedure.

Document required for death claim

The following documents are required to be submitted for claiming death benefit:

- Insurance company’s standard claim form duly filled;

- Death certificates as may be issued by the National Database Registration Authority (NADRA), or the Union Council, or the Hospital;

- Original insurance policy documents;

- Copies of the Computerized National Identity Card (CNIC) for nominee/ beneficiary and the deceased;

- Police report and post mortem report, in case the death occurred due to accident;

- Hospital and medical records, if applicable; and

- Any other document as may be prescribed.

Documents required for a disability claim

The following documents are required to be submitted for claiming disability insurance:

- Claim forms;

- Hospital /medical records, X-rays and other treatment records, wherever applicable;

- Disability certificate from an authorized doctor or as stated in the insurance policy document;

- Police report and medico-legal officer (MLO) report, wherever applicable; and

- Any other document as may be prescribed under the insurance policy;

It may be noted that requirements for documents may vary between insurance companies.

*For further guidance you may click on the following link to access the guide on Investment Basics:

Mutual Funds Related Investments:

Risk of investing in mutual funds and VPS

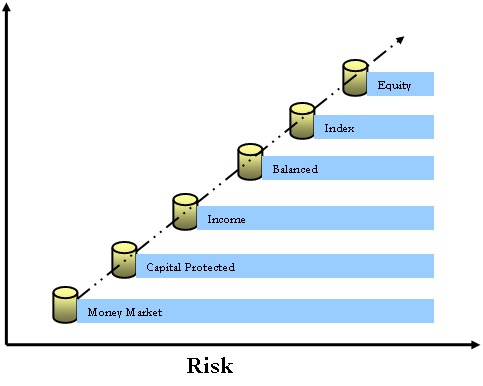

All investments in mutual funds are subject to market risks, and you may lose some or all of your money if the securities held by the fund move up and down in value. Past performance is not necessarily indicative of future results. The NAV based prices of units and any dividend/returns thereon can fluctuate as market conditions change. Funds with higher rates of return may take risks that are beyond your comfort level and may be inconsistent with your financial goals. All funds carry some level of risk as illustrated in the figure below.

Depending on the investment objective and category, a mutual fund can be subject to any or all of the following risks which could affect a fund’s performance.

Market risk

Overall “market risk” is the greatest potential danger for investors in stocks funds. Stock prices can fluctuate for a broad range of reasons such as the overall strength of the economy or demand for particular products or services. This risk also known as systemic risk is caused by the economic, geographical, political and social factors of the specific market where the stock is listed.

Credit risk

The risk that the issuer of securities, for example TFCs, held by the mutual fund fails to meet its debt obligations. Similarly, there is a probability that an investment will go down in value, if the issuer of the security is downgraded by a reputable credit rating service.

Interest rate risk

The value of an investment will decline due to a change in the absolute level of interest rates. Normally, rise in interest rates during the investment period may result in reduced prices of the held securities. Funds that invest in longer-term bonds tend to have higher interest rate risk.

Liquidity risk

This arises from lack of marketability of an investment that cannot be quickly sold to convert to cash without incurring a loss. Thinly traded securities carry the danger of not being easily saleable at or near their real values. Liquidity risk is a characteristic of the fixed income market.

Please note that to reduce risk of loss it is always advisable to consult with your investment advisor /broker. While risk cannot be eliminated, the experience and expertise of mutual fund managers in selecting fundamentally sound securities and timing their purchases and sales may result in a diversified portfolio that minimizes risk while maximizing returns.

*For further guidance on Mutual Funds and VPS kindly click on the relevant link below to access complete guide books:

- Mutual Funds Guide

- VPS Guide

Complaints/Claims

In case of complaint, immediately lodge online complaint/claim with the relevant stock exchange. You may also lodge your complaint with SECP through the following web link: