AML/CFT:

Money Laundering (ML) and Terrorist Financing (TF) are economic crimes that threaten a country’s overall financial sector reputation and expose financial institutions to significant operational, regulatory, legal and reputational risks, if used for ML/TF. An effective Anti-Money Laundering and Countering the Financing of Terrorism regime requires financial institutions to adopt and effectively implement appropriate ML and TF control processes and procedures as an essential tool to avoid involvement in ML and TF.

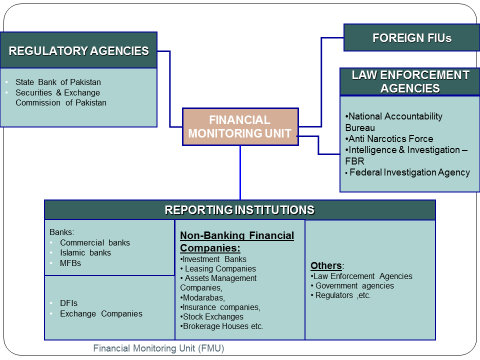

Securities and Exchange Commission of Pakistan (“SECP”), in order to maintain the integrity of its regulated financial sector inter-alia; the brokers, insurers, NBFCs and modarabas, in respect of preventing and combating ML/TF, notified the SECP AML/CFT Regulations, 2018 and issued supplementary guidelines to help regulated entities establish systems to detect ML/TF and prevent abuse of their financial products and services.

Link to FATF website http://www.fatf-gafi.org/

High-risk and other monitored jurisdictions http://www.fatf-gafi.org/

International Obligations

The UNSCR 1617 requires all Member States to implement FATF’s AML/CFT Recommendations.

FATF was established in Paris (1989) by G-7 Summit to combat Money Laundering. Countering Financing of Terrorism mandate was added to the organization after September 11, 2001 attack on the United States.

Pakistan is a member of Asia Pacific Group- FATF Styled Regional Body and is required to adopt FATF standards as per membership obligations

FATF’s Functions and Tasks:

a) Identify ML/TF threats to the integrity of the financial system;

b) Develop and refine international standards for combating ML/TF;

c) Assess and monitor its Members through peer reviews;

d) Engage with high-risk jurisdictions in their national regimes.

FATF 40 Recommendations

Money laundering and confiscation, Terrorist Financing and Financing of Proliferation: Criminalize ML/TF; means to detect, freeze, seize, confiscate proceeds and funding, freeze of terrorist assets, financial sanctions related to proliferation

Preventive measures - Financial institutions and DNFBPs: CDD, record keeping, STR, internal control, regulatory and supervisory measures

Power & responsibilities of competent authorities: Financial Intelligence Unit, law enforcement authorities, supervisors; their powers & resources

International cooperation: Mutual legal assistance, extradition, information exchange

FATF maintains two public documents

- Global Ongoing Compliance: for countries with AML/CFT weaknesses and which commit to implement Action Plan (Grey List);

- Public Statement: for high risk jurisdictions (Black List)

Impact of Non-Compliance with FATF Standards

- Negative impact on foreign direct investment;

- Decrease in international trade;

- Increased cost of doing business;

- Higher compliance costs for financial institutions;

- Enhanced due diligence of financial transactions;

- Difficulties in correspondent relationships;

- De-risking of international transactions;

- Financial sanctions on high-risk jurisdictions

- Pakistan placed under ICRG process resulting to more efforts, resources and time required to exit the process which has put Pakistan under close scrutiny.

- Possibility of being listed in FATF’s Public Statement

- Negative perceptions as being providing for criminals

- Impact on integrity of Pakistan’s financial system which perceived as vulnerable to infiltration / abused by criminals

- Corruption, crimes rate and unemployment on the increasing trend.

AML/CFT Regime in Pakistan

Role of SECP

SECP AML/CFT Regulations, 2018

SECP AML/CFT Guidelines for Non-Profit Organizations (NPOs)