Risk is generally defined as a possibility of suffering from any harm. In financial terms, risk is used to refer to the probability of an unexpected return on any investment and is measured as deviation from mean or expected return. Thus, it is deviation from the desired outcome – this can be zero return, a low return or even a higher return than expected.

Usually, high risk has the potential to bring in high returns. Shares usually come with higher returns, however; they are also associated with higher risk. Someone looking for higher return must take higher risk and one who wants to avoid risk must expect lower returns.

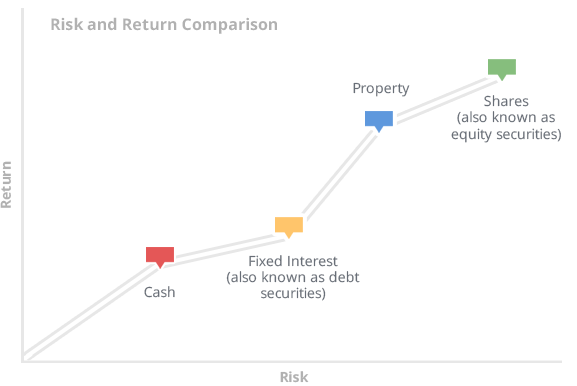

Risk and return comparison is illustrated below for the various asset classes: