If the investors have any complaints regarding their investment, the following information shall be useful in lodging the complaint. The information below is categorized in accordance with the type of investment for your convenience.

- PSX *

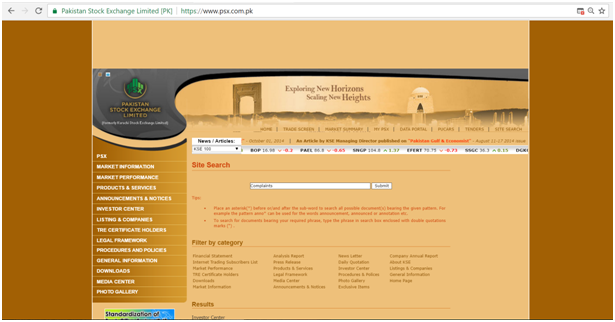

*The above link will take you to the Pakistan Stock Exchange Ltd.’s website. Please click the ‘SITE SEARCH’ button on the home page and type ‘Complaints’ in the search box. The option Investor Center will appear on the page upon your click. For your convenience a screenshot appears below:

The guidance you are seeking for your complaint’s redress will be made available to you by clicking PSX Investor Center link under 'RESULTS', an example of which appears below:

Lodging a Complaint

Insurance

The SECP plays a facilitating role by taking up complaints with the respective insurers. Following points should be taken into account before lodging a complaint with the SECP.

Policyholders who have complaints against insurers are required to first approach the Grievance/ Claims/ Complaints Cell of the concerned insurer. If they do not receive a response from insurer within a reasonable period of time or are dissatisfied with the response of the company, they may then approach the SECP for the resolution.

Policyholder Complaints

If someone purchases an insurance policy, and at the time of purchase there was misrepresentation with respect to the returns promised under the policy, the fees to be deducted from the premium, or on the occurrence of the claim, the insurance company says that it is not liable to pay for the losses for reasons such as:

- The peril was not covered;

- The policy had exclusions;

- They have a limit to pay, etc.; or

- It is taking longer than usual to process the claim.

Then, the policyholder has certain readily available recourse mechanisms. Some of the steps are mentioned below:

- The policyholder can write to the insurance company regarding his/her grievance while stating their intention to file a complaint with the office of the insurance ombudsman;

- If the insurance company does not give satisfactory reply within one month, the policyholder can file an application with the office of the Insurance Ombudsman within three months. The Federal Insurance Ombudsman is an autonomous national dispute resolution body which is expected to independently and impartially resolve insurance disputes between insurance policyholders and participating companies, without charging any fees;

- A complaint is required to be made on solemn affirmation or oath in writing addressed to the Federal Insurance Ombudsman. The complaint must set out the full particulars of the complaint matter and the name and address of the complainant. Complaint can also be made online by visiting their website at www.fio.gov.pk/

Federal Insurance Ombudsman contact address:

Federal Insurance Ombudsman’s Secretariat

2nd Floor, Pakistan Red Crescent Society Annex Building

Plot # 197/5, Dr. Daud Pota Road

Karachi, PAKISTAN

Tel: +92 21 992 077 61 (62 and 63)

Fax: +92 21 992 077 63

Email: info@fio.gov.pk

Website: www.fio.gov.pk

For guidance on matters regarding insurance, you can also write to the Insurance Division of the Securities and Exchange Commission of Pakistan at the following address.

Securities and Exchange Commission of Pakistan

Insurance Division

63-Jinnah Avenue, Blue Area

Islamabad, PAKISTAN

Website: www.secp.gov.pk

Additional Complaint Resolution Forums

Under the Insurance Ordinance, 2000 there are two additional complaint resolution forums:

Insurance Tribunals

Thisis a body, constituted under the Insurance Ordinance by the federal government, with the authority to judge, adjudicate on, or determine claims or disputes. In essence, it is a specialized court formed for the disposal of cases pertaining to the Insurance business.

The federal government has conferred powers in each province on the District and Session Courts to exercise territorial jurisdiction as under:

| Name of Sessions Court | Territorial Limit |

|---|---|

| District & Session Judge Lahore | Whole Province of Punjab |

| District & Session Judge Karachi | Whole Province of Sindh |

| District & Session Judge Peshawar Pakhtunkhwa | Whole Province of Khyber |

| District & Session Judge Quetta | Whole Province of Baluchistan |

Small Dispute Resolution Committees (SDRC)

The SECP has constituted three small dispute resolution committees in the cities of Karachi, Lahore and Islamabad for resolution of disputes arising between the insurers and the policyholders. Each Committee can resolve disputes up to the following limits:

| Nature of the Underlying Insurance Policy | Maximum Sum Insured Rupees |

|---|---|

|

Individual life contract |

One Million Only |

|

Domestic insurance policy |

Two Million Only |

|

Private motor insurance policy |

One Million Only |

The jurisdictions of the committees are as follows:

| SDRC Committee | Jurisdiction |

|---|---|

| SDRC –Karachi | Sindh & Baluchistan |

| SDRC – Lahore | Eastern Side of Punjab (All districts of Punjab except Bhakkar, Khushab, Mianwali, Jhelum, Chakwal,Rawalpindi and Attock) |

| SDRC – Islamabad | Islamabad Capital Territory, province of Khyber Pakhtunkhwa, (including Gilgit Baltistan / Federally Administered Tribal Areas), Azad Jammu & Kashmir,and the western side of the province of Punjab i.e.Bhakkar, Khushab, Mianwali, Jhelum, Chakwal,Rawalpindi and Attock districts |

The process for filing complaints with SECP is as follows:

For Submitting your Complaint Online please click on the following link:

Service Desk for Online Complaint Registration

The complaints need to be forwarded to the address given below:

Service Desk

Securities & Exchange Commission of Pakistan

4th Floor, State Life Building No.2,

Wallace Road, off I.I. Chundrigar Road,

Karachi, Pakistan.

Alternatively, they may be emailed to

Only cases of delay/non-response regarding matters relating to policies and claims are taken up by the SECP with the insurers for speedy disposal.

In case of claims/policy contracts in dispute that require adjudication the insurance policyholders are advised to approach the available quasi-judicial or judicial channels i.e. the Insurance Ombudsman, Consumer Protection Forum or the Civil courts for such complaints. Contact details are also available in the Service Desk and Complaint Guide 2016 available on the SEC website.

Mutual Fund/Pension Fund

In case of any issue with the mutual fund/pension fund, investors are advised to lodge a complaint with the specific Fund Manager before approaching the SECP. If you are not satisfied with the manner in which your complaint is handled, you may use any of the following options to lodge your complaint:

For Submitting your Complaint Online please click on the following link:

Service Desk for Online Complaint Registration

To mail your complaint by Post, please send it at the following address:

Securities and Exchange Commission of Pakistan

National Insurance Corporation Building,

Jinnah Avenue,

Islamabad-44000, Pakistan.

Or alternatively, they may be emailed to

Leasing Company/Investment Bank

In case of any issue with the Leasing company/Investment Bank, investors are advised to immediately lodge a complaint within 15 days of lodging the claim. If you are not satisfied with the manner in which your complaint is handled, you may use any of the following options to lodge your complaint:

For Submitting your Complaint Online please click on the following link:

Service Desk for Online Complaint Registration

To mail your complaint by Post, please send it at the following address:

Securities and Exchange Commission of Pakistan

National Insurance Corporation Building,

Jinnah Avenue,

Islamabad-44000, Pakistan.

Or alternatively, they may be emailed to